Why Financing IT Equipment with Structured Commercial Loans Instead of Cash is Better for Business

With more people working from home, businesses must be on top of their information technology (IT). Businesses need low-interest finance that is structured to complement their existing cash flow. Financing IT equipment with cash can be a huge outlay, so we are seeing more businesses come to us for tailored loans. Businesses need IT services, networking, massive routers, staff computers, desks, installation, and training. They also need to know where their staff are and what they are doing and be able to supply them with what they need to maintain productivity.

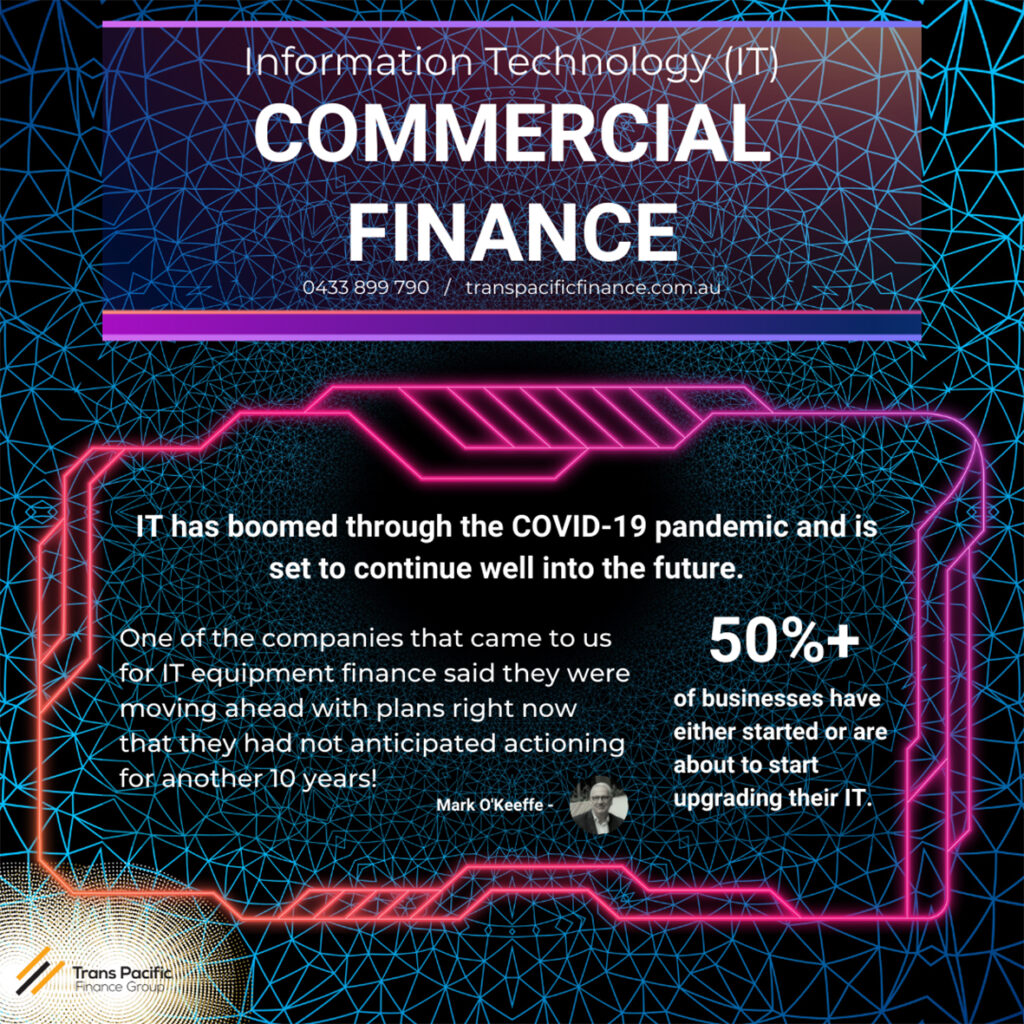

Furthermore, more customers are looking to digital to connect with businesses. As a result, IT has been one area that has boomed through the COVID-19 pandemic and is set to continue well into the future. In a sense, COVID fast-tracked where we were already heading in IT and digital transformations.

Read on to learn more about IT business transformations and upgrades and how to get advice on commercial equipment finance for your business.

Accelerated Digital and IT Transformations Actioned 10 Years Ahead of Plan

Companies have had to upgrade their IT offerings to ensure staff can work in the office and remotely well ahead of schedule. One company that came to us for IT equipment finance said they were moving ahead with plans they had earmarked for gradual development over the next decade right now.

They are not alone.

Australian businesses, small and large had no other choice but to turn to digital and IT to keep business afloat during the pandemic(*1,2). 12 months into the pandemic, in 2020, a survey conducted by Capterra indicated that 57% of businesses were either already working remotely or in the process of establishing IT systems for remote work(*3).

Tax Benefits for Improving and Upgrading IT Systems

The Australian Government has committed to giving businesses a further 20% tax deduction for digital and IT transformation costs(*4). This is intended to encourage small to medium enterprises to fast-track the adoption of new IT software and equipment, websites, and cyber security.

Why Financing IT Equipment with Commercial Loans Instead of Cash is Better for Business

Equipment and items such as IT equipment and office furniture usually depreciate in value quickly. Additionally, using cash for these purchases can put significant strains on working capital and even leave the business without enough to cover day-to-day costs.

What are the Benefits of IT Equipment Finance?

The biggest benefits of choosing finance for IT equipment over using cash include:

1. Business working capital is not depleted.

This means the business’s working capital can be held and used for unexpected expenses or opportunities.

2. Repayments can be spread out in line with the business’s cash flow.

This is particularly helpful for businesses that are significantly affected by seasonal influxes.

3. The interest rates we secure for our clients ensure they are not paying too much for their equipment and can be fixed rates.

Did you know that interest charged is tax deductible for many businesses?

4. Build the business’s financial credit rating.

5. Bigger purchasing power.

Finance allows you to buy equipment in bulk rather than in small orders which can save you money overall.

Structured Commercial Finance for IT Equipment, Installation and Staff Training

Do you need to fast-track your IT or digital transformation? We can help you obtain the finance you need to cover equipment purchases, installation, and staff training.

Get in touch today.

References

*1. O’Keeffe, M. The reason why you don't put your cash into IT Equipment. Trans Pacific Finance. YouTube video. 2022.

*2. PwC. Where Next for Accelerated Digitalisation and Data Reliance? 2020.

*3. Hammond, A. 5 Ways Australia’s Lockdown Has Fast-tracked Digital Transformation. Capterra. 2020.

*4. Australian Taxation Office (ATO). Small Business Technology Investment Boost and Small Business Skills and Training Boost. 2022.

"*" indicates required fields